I see a Mad Max world soon for those of us in the lower 99%! Note that all austerity policies around the globe only affect those "without the gold" (the richest folks), so I apologize for the digression.

Is It Better to Forgive Than to Receive?

Is It Better to Forgive Than to Receive? Repudiation of the Gold Indexation Clause in Long-Term Debt During the Great Depression

by Randall S. Kroszner, 1998.

http://faculty.chica...rs/repudiation11.pdfHere's a blockquote short version:

This paper examines the consequences of large-scale debt relief during the Great Depression in order to examine theories of debt overhang and the costs of bankruptcy.

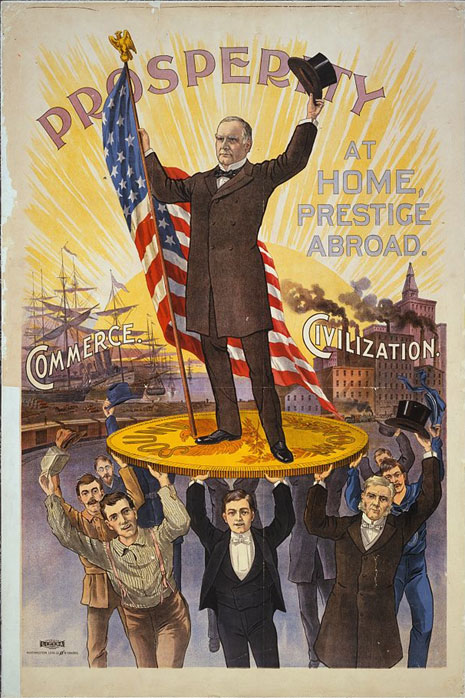

When the U.S. went off the gold standard and devalued the dollar with respect to gold, the government declared that the courts would no longer enforce gold indexation clauses which appeared in virtually all long-term private and public debts up to that time. If the gold clauses had been enforced, the debt burden of borrowers would have increased by the extent of the devaluation, which was 69 percent.

I examine asset price responses to the Supreme Court’s decision to uphold this effective debt jubilee. Equity prices rise, but more surprisingly, the debt relief also led to higher prices for corporate bonds (all of which contained gold clauses). In contrast, government bonds with gold clauses fall in value.

These responses suggest that the benefits of eliminating debt overhang and avoiding bankruptcy for private firms more than offset the loss to creditors of some chance of trying to recover the additional 69 percent. Consistent with large costs of debt overhang and bankruptcy, in the cross section, stock and bond prices of firms closer to bankruptcy rose more than other firms. The results suggest that in these circumstances it is indeed better to forgive than to receive.

_____________________________

- Following the inflation during the Civil War, almost all long-term financial contracts in the U.S. came to include a “gold clause” which effectively indexed to gold the value of the payments to creditors. This clause protected creditors against devaluation of the dollar since they could demand payment in gold or the equivalent value of gold in nominal dollars if the price of gold were to rise during the life of the contract. On June 5, 1933, Congress passed a Joint Resolution nullifying gold clauses in both private and public debt contracts. One legal authority has remarked of this Resolution: “In legal history there is probably no other statute of a purely private-law character which has engendered such enormous financial changes…”

- The abrogation of gold clauses was a key part of Roosevelt’s “first hundred days,” providing the foundation for much of the New Deal policies directed at reflating the economy including the departure of the U.S. from the gold standard. Although the Supreme Court struck down most of Roosevelt’s early New Deal programs, the Court upheld the government’s ability to alter financial contracts by refusing to enforce gold clauses. Given that the price of gold rose from $20.67 per ounce to $35 per ounce when the U.S. officially devalued in 1934, the abrogation of these clauses was tantamount to a debt jubilee….

- Justice McReynolds, in a strident and emotional dissent, decried that “the Constitution is gone” and compared the actions of the government in these cases to those of “Nero in his worst form.” The minority expressed “shame and humiliation” at the majority’s decision and found the consequences of the decision upholding repudiation “abhorrent.” With the sanctity of private contracts now eliminated and the government effectively repudiating its obligations, the dislocation of the domestic economy could be much greater in the long run than any possible short run disruptions due to gold clause enforcement….

- High Bankruptcy Costs and Debt-Deflation Hypothesis: If the costs of bankruptcy and distortions of investment incentives of debt overhang are sufficiently large, then enforcement of the gold clause could have reduced the expected payments to corporate bond holders. This occurs when the anticipated benefit of enforcement of the gold clause, which would raise nominal payments to bond holders by 69 percent times the expectation of a decision upholding enforceability, must be more than offset by the expected reduction of payments to bond holders due to bankruptcy and distorted investment incentives….

- In addition to the bankruptcy costs that affect individual firms, there could have been an external effect of massive bankruptcies and underinvestment incentives induced by a decision adverse to the government (e.g., Fisher 1933, Myers 1977, and Lamont 1995). The two-year long recovery of the economy might have been stopped and a severe crisis could have arisen as individual firm bankruptcies led to further waves of failures of financial intermediaries and to broad financial and economic collapse…

- VII. Conclusions

- The evidence presented above is consistent with the “high bankruptcy costs and debt deflation” hypothesis. The debt repudiation that was the practical effect of the gold clause decision increased the value of both debt and equity, and firms with greater likelihood of experiencing financial distress had the greatest increase in the value of their securities. These preliminary results suggest that models emphasizing debt overhang and the costs of financial distress may have empirical relevance for evaluating policies of debt relief for both firms and nations.

It really shows what a total bad ass Franklin Roosevelt was back in the day compared to our leaders today.