@Ren - So ok. Next week I need to: buy some hardware for a client project, get a new set of flatwound bass strings (Daddario Chromes!), pay a few utility bills, pick up some groceries, buy another friggin' tank of gas, and pay my GF's car tax. Assuming I had $3000 in a Bitcoin account - could I use it for any of the above? That's what I mean by "for mainstream purposes."

My earlier question wasn't meant to be a challenge. I'm just seriously interested in where you can use botcoins for non-geek types of products and services. Because if I'm going to introduce an additional point of potential theft, fraud or failure into my financial life (to complement the risk I already have using my country's banking system and legal currency) then I'd like to at least be able to use it on a day to day basis. That's all.

-40hz

Well, it isn't everywhere. Yet. But it is becoming more accepted all the time.

Places to use bitcoin? Well, yeah, mostly geeky stuff at the moment. But, there are others:

Buy gold & silver with bitcoin here:

http://coinabul.com/A LARGE list of places here:

https://www.spendbitcoins.com/places/A lot of geeky stuff there, but also some surprises. Guitar lessons, an architect, and others. Mostly small places, but that just shows that it is a grassroots uprising against the totalitarian control of fiat currencies by central banks.

Many places ONLY accept bitcoin. Those are often bitcoin related though, like ASIC hardware manufacturers, bitcoin mining companies, etc.

So, for the moment... nope. No gas, milk, or slurpees. But I dimly recall an article about bars in Spain taking bitcoin for beer and other libations.

As for governments clamping down on it... well... it's a bit too late for that. It's P2P which pre-empts the possibility of the obsessive central control that authoritarian governments so crave. The power of the bitcoin is in the network. Pandora's box has been opened. There is no going back. This is the same thing as 3D printing an AR-15 lower receiver - the information is out there. It's too late. The cat is out of the bag. Game over. The control freaks lost.

Will they try to control it? Hell yes! Can they? No. TOR. VPNs. Strong encryption. P2P. Anonymous networks. Just some of the reasons that they will fail.

Mainstream purchases are still a ways away, but with the dark forces of the IMF, Angela Merkel, and their other central banking criminal friends trying to steal money from bank accounts in Cyprus... Well, they have exposed their intentions and permanently undermined faith in banking. It will only get worse. They will try again, and there will be runs on banks that spiral out of control.

Back in 2010 I thought about dumping some money into BTC. Had I have done that, sigh... I'd never work again... hind sight is 20/20. Oh well. It's still pretty much ground floor.

As for investment vs. speculation... I really don't care what term is used.

I think it more accurate to characterize it as giving Bitcoin the spotlight rather than credibility. The simple fact its valuation is zooming up so rapidly is a positive indication (to me at any rate) that the arbitragers, always out to make a quick buck, have scented an opportunity (i.e. money + publicity + amateur investors) and are starting to move in on it. If I'm correct, bitcoins will continue their rapid rate climb for a few more months before it all tanks when the pros suddenly cash out en masse.

-40hz

There is always market manipulation. That's a given. Stocks/bonds/funds/commodities/equities/whatever - they are all manipulated.

But the price will continue to go up no matter what. Will there be retracements? Sure. But they will always rebound. This is a mathematical certainty.

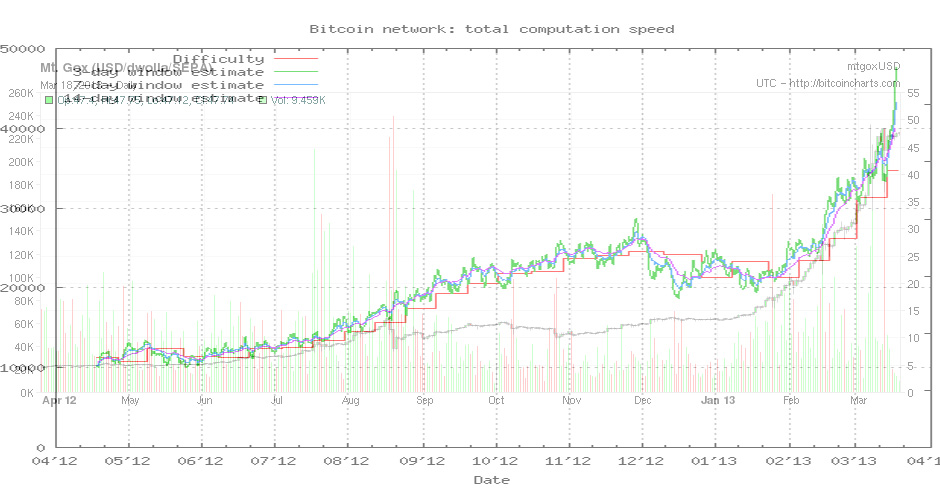

This is an overlay of the price of BTC and the difficulty factor. As you can see, there is a very strong correlation. You can find those charts out there then go check yourself to see the correlation. Difficulty factor is constantly increasing, as is the price of BTC.

Now, the most recent spike has illustrated not a relationship to difficulty factor, but has illustrated accelerating adoption and faith in BTC. (It spiked with the Cyprus "haricut" announcement.)

So, we have 2 fundamental factors affecting the value of BTC:

1) Difficulty factor

2) Faith & adoption

Looking at the overlay before Cyprus, I initially thought that BTC was overvalued last October/November/December. However, I'm not so sure of that now. It looks more as though BTC has simply been undervalued. In other words, the difficulty factor is the minimum valuation factor for BTC, which it has pretty much followed to date, and that the market valuation has mostly relied on difficulty factor, but with accelerating adoption the difficulty factor will play less of a role as social factors take over. Difficulty factor will remain the baseline though, and the level that it will not fall through. i.e. Difficulty factor provides strong support, while skepticism or slow adoption provides the basic resistance.

The notion that just because market manipulators cash out or make money isn't really any kind of a valid argument against BTC (or anything) as the market simply continues. We've seen lots of market manipulation in the past, but it simply is a part of the market and you can still look at technical analysis with a good degree of faith. i.e. Market manipulation doesn't preclude the opportunity for other people to hop on board and make money. You simply need to be aware of what is going on and plan ahead.

If BTC drops by half, I'm not really worried as the difficulty factor will still kick in and push it up. The introduction of ASIC mining hardware will accelerate the price of BTC as well.